Fact Sheet

Kyriba Working Capital White Label Solutions for Financial Institutions

Table of Contents

As Working Capital Solutions Evolve and Grow, Stay Ahead of the Curve

Now more than ever, CFOs and senior finance leaders are turning to working capital solutions to optimize liquidity and generate free cash flow. With the demand continuing to grow, so do the market options.

To compete more effectively, financial institutions (FIs) can partner with a technology provider who will help them elevate and differentiate their offering – now and over the long term. As a global leader of enterprise liquidity management platform, Kyriba is an ideal SaaS partner. Our cloud technology serves more than 2,500 corporate CFOs and treasurers including one quarter of the Fortune 500. Kyriba is a name your customers know and trust.

Kyriba Working Capital Solutions

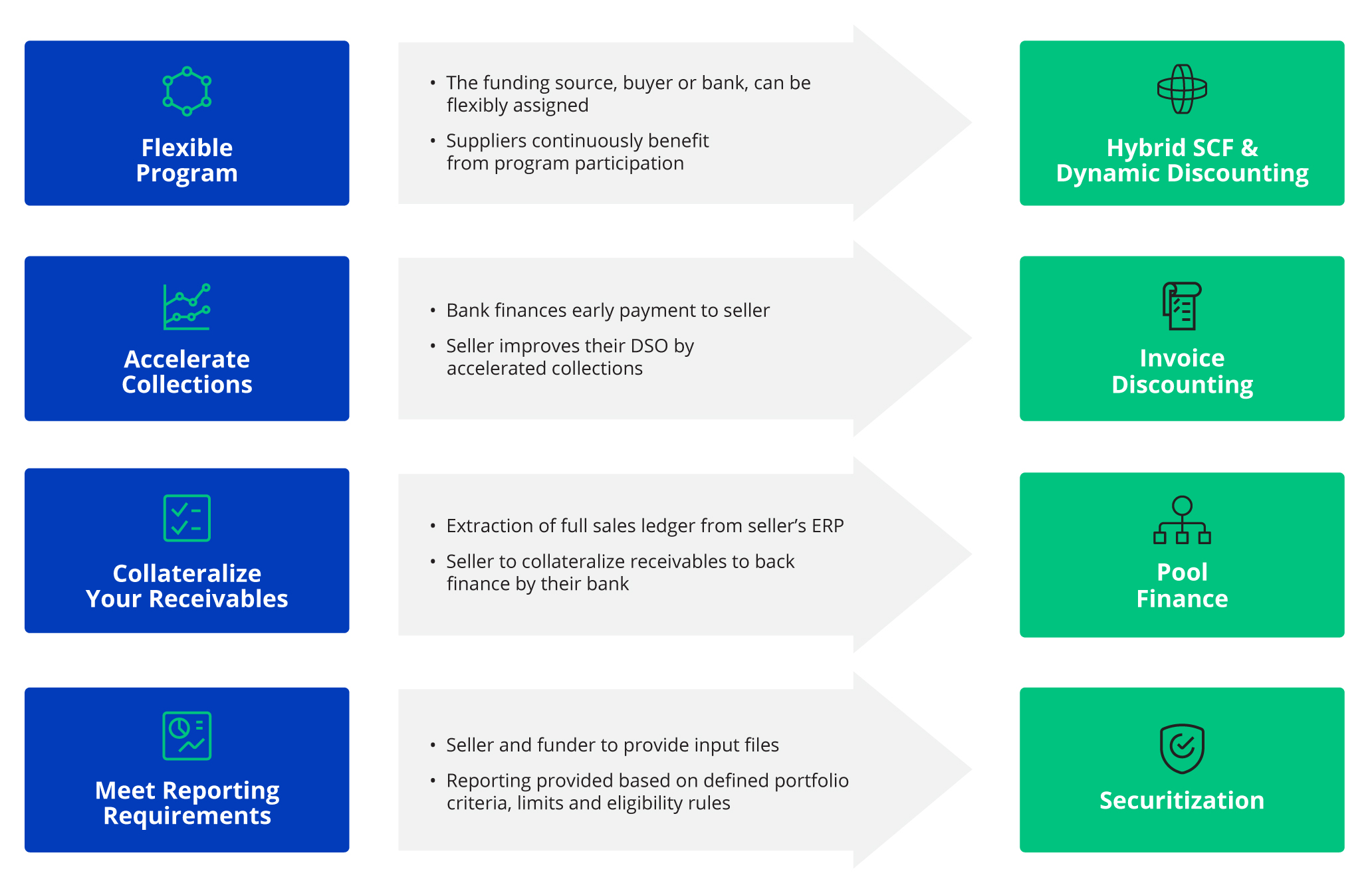

With Kyriba, FI partners can support their corporate clients with a variety of working capital solutions.

On payables finance side, there is not only approved payables finance and dynamic discounting, but also a special hybrid program to seamlessly switch between these two main structures. Purchase order finance is also available in pilot phase.

On receivables finance side, the products range from off-the-shelf invoice discounting to sophisticated

securitisation reporting.

Kyriba’s working capital solutions prioritize the customer experience – from supplier onboarding to ERP integration to funding requests and reporting. System users enjoy a seamless experience, keeping informed and engaged without sacrificing convenience.

Why Partner with Kyriba for Working Capital

- Customer-facing solutions, focusing on user experience

- Modular solutions – only white label what you need or the fully integrated platform

- Supplier onboarding can be used independently and leveraged bank wide

- Our partnership extends beyond technology

- We support rather than compete with our FI partners

- We do not fund or structure transactions

FIs can leverage Kyriba’s state-of-the-art technology, deep industry expertise and global reputation to gain a competitive edge for their enterprise liquidity products and services.

The Kyriba NetSuite API Integrated Payments Workflow Explained

Kyriba Working Capital Solution – Leading Technology, Security and Support

- Corporate ERP Connectivity Experts

At Kyriba we know ERP connectivity with extensive integration experience across our global customer footprint. We support both API and host-to-host options for working capital and beyond. - Strong White Labeling Functionality

Kyriba makes it easy to deliver a fully integrated product that can be customized and branded to proper specifications. This includes marketing and web site content, translations, URLs, privacy notices, email templates, and branded web portals. - Quick Time to Market

Financial institutions can get up and running quickly with Kyriba thanks to proven infrastructure and a professional services team that helps to set up and model the programs. - Flexible Backend Integration

Kyriba’s working capital solutions are designed to interface with a wide variety of third-party banking applications – including trade finance, payment and core banking systems. - Bank-Level Security and Data Protection

Financial institutions and their clients require the highest levels of security. Kyriba delivers across four pillars of security: physical security, vendor security, application security and process security, including SOC 1 Type II and Soc 2 Type II certification. Finance data is also secured with ISO 27001 certification. - A Proven Global Approach

Kyriba offers global implementation, onboarding and a ‘follow the sun’ support service approach.