FAQ

What is Working Capital Management?

Working capital management involves managing a company’s short-term assets and liabilities to ensure efficient use of resources and maintain the financial health of the business. It includes balancing current assets and liabilities to meet operational needs while preserving liquidity.

Table of Contents

- How Is Working Capital Calculated?

- Why Is Working Capital Important?

- What Does Negative Working Capital Mean?

- How Can Working Capital Be Optimized?

- What is a Working Capital Program?

- What is Reverse Factoring?

- How Can Financial Institutions Benefit from Working Capital Management Strategies?

- Choosing the Right Working Capital Solution

- Mastering Working Capital for Financial Excellence

How Is Working Capital Calculated?

Working capital is calculated by subtracting a company’s current liabilities from its current assets. It represents the available capital a company can use for its daily operations and is indicative of the company’s short-term financial health.

Working Capital = Current Assets – Current Liabilities

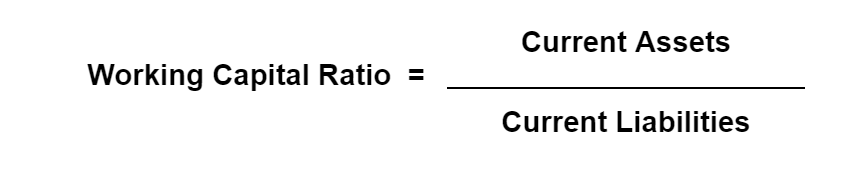

Additionally, it can be helpful to calculate the working capital ratio, also known as the current or liquidity ratio. To calculate the working capital ratio, divide a company’s current assets by its current liabilities.

Working capital metrics are essential for measuring available funds for operations and growth.

Why Is Working Capital Important?

Working capital is crucial as it funds daily operations, pays bills, and makes investments. If not managed properly, businesses may struggle to pay bills, hire new employees, upgrade equipment, or invest in new projects. Effective administration of working capital is essential to running a successful business.

What Does Negative Working Capital Mean?

Negative working capital occurs when a company’s current liabilities exceed its current assets. It indicates that the company may struggle to finance its daily operational needs and meet its short-term debts, potentially leading to financial distress.

Negative working capital can have a significant impact on a company’s operations and financial health. Consequences of negative working capital include:

- Cash flow problems, as the company is unable to meet its financial obligations

- Reduced profitability

- A decrease in the company’s credit rating

- Inability to secure additional financing

If negative working capital is not addressed, it can eventually lead to insolvency and bankruptcy.

How Can Working Capital Be Optimized?

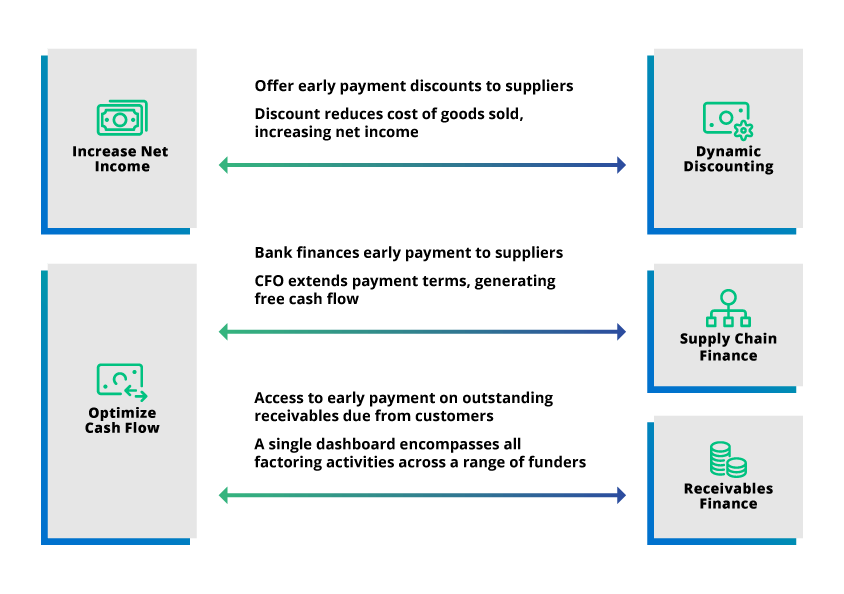

Optimizing working capital involves finding the right balance between current assets and liabilities. It can be achieved through careful inventory management, efficient handling of accounts receivable and payable, and accurate cash flow forecasting. Simply put, optimizing working capital means mobilizing liquidity by injecting cash into supply chains.

What is a Working Capital Program?

A working capital program is a strategy to optimize working capital. It includes measures like payables finance and receivables finance solutions, which allow organizations to fully leverage their supply chain and optimize payment terms.

A program to optimize working capital may involve offering suppliers the ability to take early payments for invoices on demand, which has the following benefits:

- Supports and protects suppliers

- Shields organizations from shocks

- Allows suppliers the ability to do more business

With a working capital program in place, organizations can easily tie sustainability objectives with financial incentives to encourage better behaviors as opposed to punishing suppliers for negative behaviors.

What is Reverse Factoring?

Reverse factoring is a supplier finance solution that optimizes cash flow by allowing sellers to be paid early for unpaid receivables from customers. It’s a strategy that can help unlock working capital.

To find out how one company effectively uses reverse factoring to transform supplier finance, read the following Kyriba success story: Modernizing International Supplier Finance with Reverse Factoring Programs.

How Can Financial Institutions Benefit from Working Capital Management Strategies?

Financial institutions can differentiate themselves from the competition and foster better relationships with corporate clients by offering working capital programs. These programs can help businesses optimize their working capital, thereby improving their financial health. Financial institutions, such as banks, will often partner with technology vendors to create white label programs for supply chain finance.

Some of the reasons banks choose to partner with technology vendors are:

- SaaS environment: eliminates the need for technical hardware and support

- Highly configurable software: customizable features that easily adjust to programs (by buyer, funder, and jurisdiction requirements)

- Automated processes: loads files, e-notifications, sell offers, purchases, early payments, and final settlement

- Fully-integrated products: technology vendors like Kyriba makes it easy to deliver a fully integrated product that can be customized and branded to proper specifications, such as marketing and website content, translations, URLs, privacy notices, email templates, and branded web portals.

- Stand out from the competition: elevates and differentiates a financial institution’s offerings, both in the short- and long-term

Choosing the Right Working Capital Solution

The right solution is critical to successful working capital management, whether or not an organization uses a payables finance or receivables finance program.

When evaluating software and vendors to support these programs, it is imperative that organizations look for a solution with expert teams, a multi-funder platform, program flexibility, supplier onboarding, and a complete workflow — including cash visibility, forecasting, payments, and pre-built ERP integration.

Kyriba’s Working Capital Solution meets these criteria and enable companies to improve payables and receivables management, increasing cash conversion and accelerating cash flow.

Below are some of the benefits Kyriba clients are taking advantage of by choosing Kyriba’s Working Capital Solution, including mitigating supply chain risks with flexibility, certainty, and corporate responsibility:

- Flexibility: with supply chain finance, dynamic discounting, and purchase order financing, companies use liquidity from the most efficient sources at different stages of trading

- Certainty: an integrated cash forecasting solution increases the accuracy of cash and working capital projections, enabling finance and treasury teams to optimize their use of internal and external cash pools to unlock additional liquidity for suppliers across the globe

- Sustainability: buyers can more easily work with sustainability-minded businesses who have greater access to affordable capital for all suppliers and the capacity to supplement corporate social responsibility (CSR) and environmental, social, and government (ESG) programs

Kyriba’s cloud-based treasury and finance solutions can help you take control of your working capital with modules such as dynamic discounting and approved payables financing (supplier finance), including a special hybrid of both.

Kyriba’s supply chain finance (SCF) solutions, which is also part of the Kyriba’s Working Capital Solution, prioritize the customer experience – from supplier onboarding to ERP integration to funding requests and reporting. System users enjoy a seamless experience, staying informed and engaged without sacrificing convenience.

Mastering Working Capital for Financial Excellence

From calculating working capital to the implications of negative working capital, each aspect of working capital management plays a role in determining operational agility and growth potential. Strategies to optimize working capital include careful inventory management, efficient accounts handling, and precise cash flow forecasting. These approaches pave the way for mobilizing liquidity and injecting cash into supply chains, ensuring a balance between assets and liabilities. Implementing effective working capital management is not just a financial necessity; it stands as a strategic imperative for sustainable success.