Fact Sheet

Kyriba Liquidity Analytics

Kyriba’s Liquidity Analytics is part of the comprehensive SaaS-based Kyriba Analytics reporting platform giving CFOs and treasury the ability to identify enterprise-wide, integrated cash, coupled with debt and investment data presented with superior visualization and analysis. Liquidity management across the organization becomes more strategic, insightful and faster with the latest Kyriba Analytics offering:

Table of Contents

Analyzing the Net Financial Position

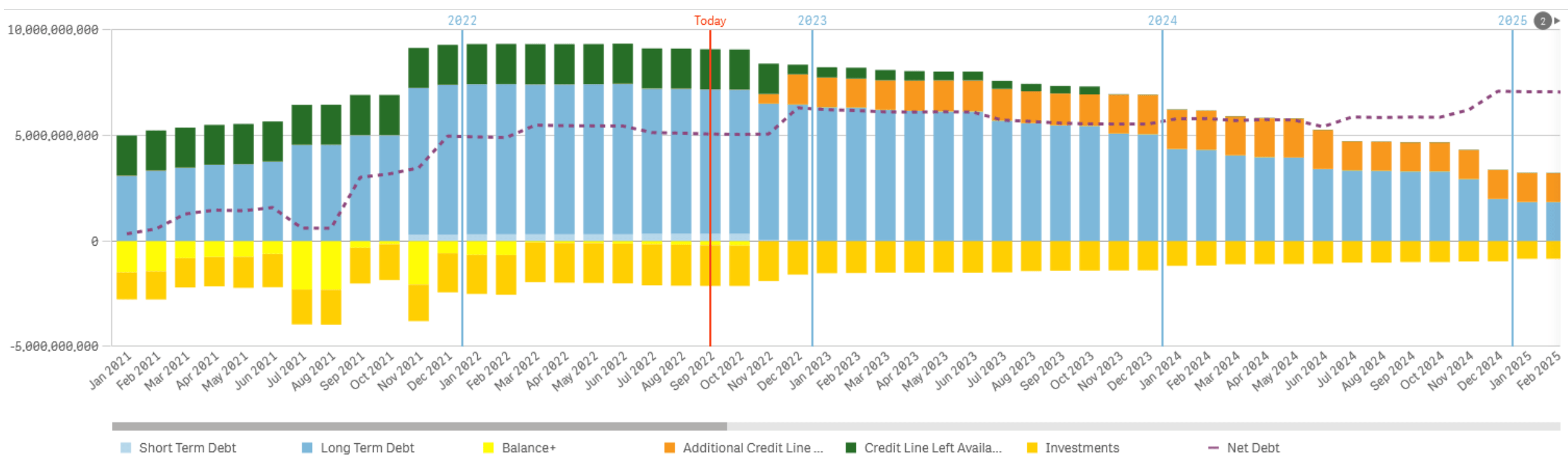

To gain a comprehensive understanding of the financial position of a company, it is essential to analyze the variation of net debt over time. This analysis can provide insights into how the company’s liquidity has changed over a given period and whether these changes are a cause for concern. The examination of intercompany loans across subsidiaries as part of the net debt allows analyzing the role of in-house liquidity for the group. The breakdown by currency increases visibility into the associated forex exposures prior to hedging.

To counter the delays in reporting typically experienced from non-integrated, spreadsheet-based tools, Kyriba’s solution brings the treasury data and financial transaction records together intraday to calculate the net debt position. By using these resources, Liquidity Analytics offers a current picture of the organization’s financial standing, enabling the CFO to make informed decisions and take appropriate actions to manage and mitigate financial risks.

Building a Solid Financial Plan

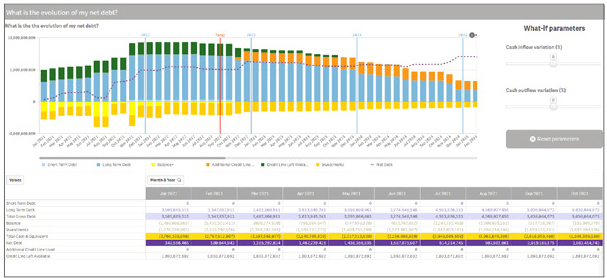

Liquidity Analytics allows optimized financing from the planned evolution of working capital and capital expenses. The ability to forecast the company’s funding requirements in relation to its financial resources increases the effectiveness of planning and managing the financial operations of the company.

In an economic climate that is fraught with uncertainty, it is imperative for the CFO to make contingency plans that account for various business scenarios, both those that anticipate growth and those that defend against downturns. Liquidity Analytics enables stress testing of cash inflows and outflows, thus validating the strength of the financial plan against the pressure of a volatile market. By utilizing this tool, the CFO can ensure that the company’s financial plan is resilient and can withstand a variety of potential economic scenarios.

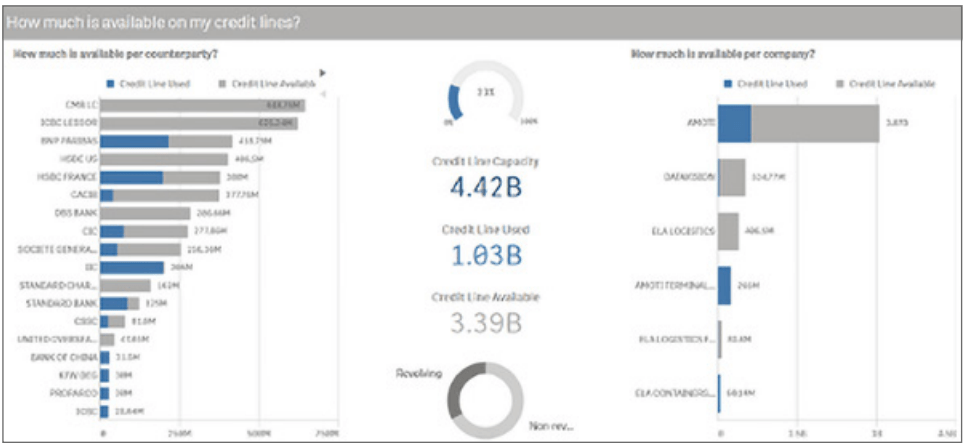

Controlling Liquidity

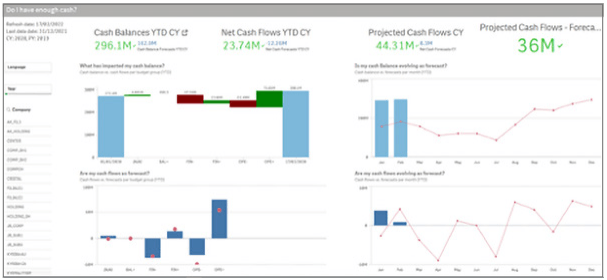

Liquidity ratios play a crucial role in determining a company’s credit rating and subsequently its cost of debt. Liquidity Analytics provides both historical variations in liquidity and its future evolution anticipated from financial planning. This analysis encompasses not only cash and cash equivalents, but also committed credit facilities.

The tool can also aid in mitigating credit risk by exercising control over the allocation of the liquidity portfolio across banks, thereby avoiding any potential concentration of funds. By ensuring that the liquidity portfolio is diversified and not concentrated in a single institution, the solution helps reduce the risk of over-reliance on any one bank, thus contributing to the financial stability of the company.

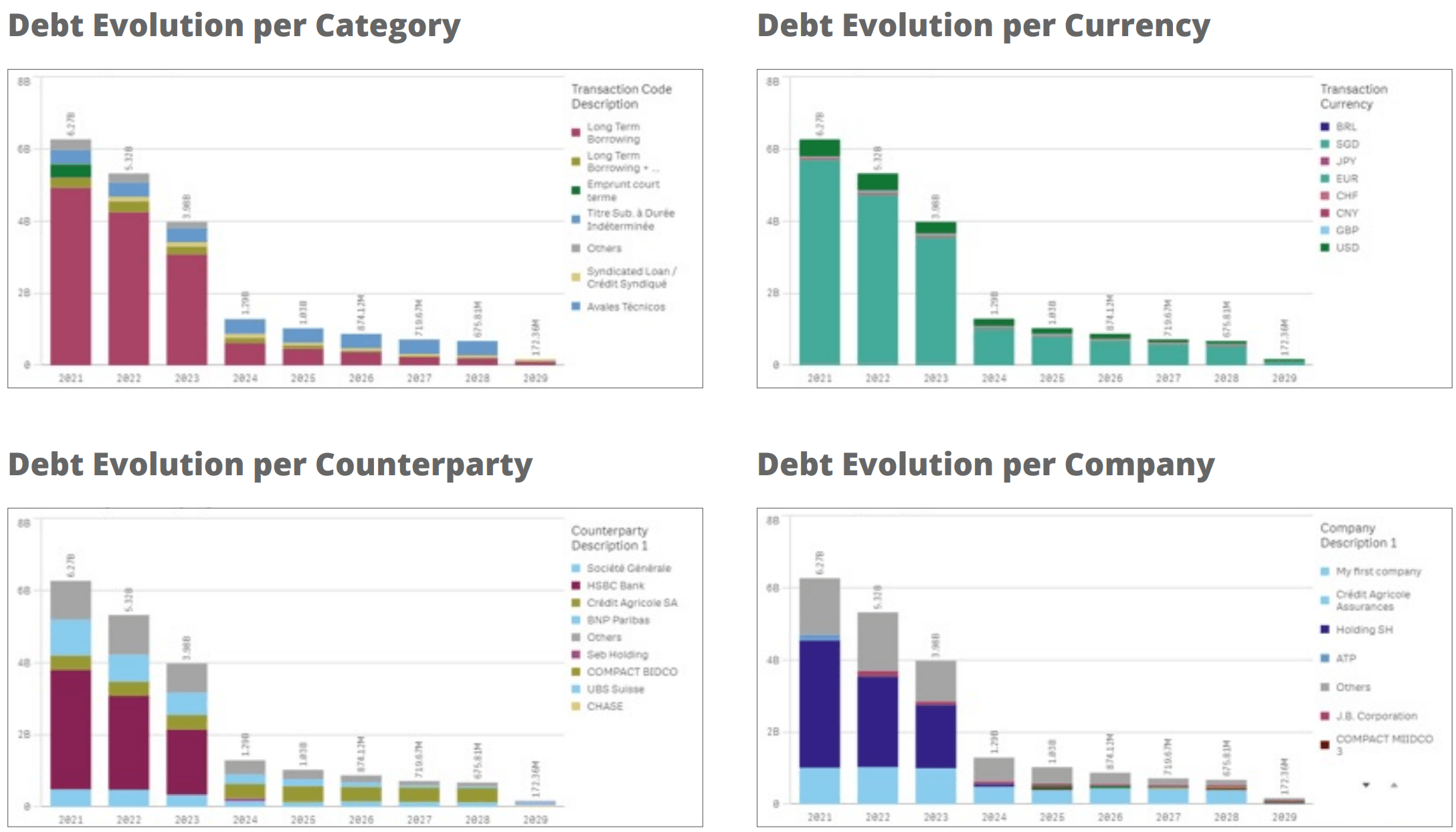

Analyzing the Structure of Your Debt Portfolio

Analyzing and optimizing your debt portfolio over time is crucial in order to minimize interest expenses. Liquidity Analytics expands the CFO’s effectiveness in calculating and forecasting the exposure to interest rates volatility. Future interest rate what-if combined with liquidity stress test provides an estimate of the cost of the financial plan by scenario. This analysis helps the CFO make informed decisions regarding the company’s financial operations and ensure the cost of the debt is minimized in the long term.

Kyriba Analytics Reporting Platform for CFOs and Treasurers

Besides Liquidity Analytics, Kyriba also offers a full suite of analytics for Cash, Payments, Risks, Compliance and Supplier Finance.

Liquidity Analytics

- What is my net debt and my liquidity?

- How and when best to pay down my debt?

- How many “days of survival” do I have?

Cash Analytics

- Do I have enough cash?

- Are my cash forecasts reliable?

- What is my activity with banks?

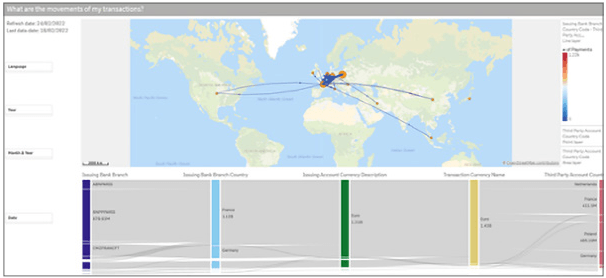

Payments Analytics

- Where is my biggest concentration of payments?

- Are we sending too many wires?

- Which users execute payments and who approves them?

Risk Analytics

- How much is available on my credit lines?

- What is my borrowing profile?

- What is the value of my financial assets?

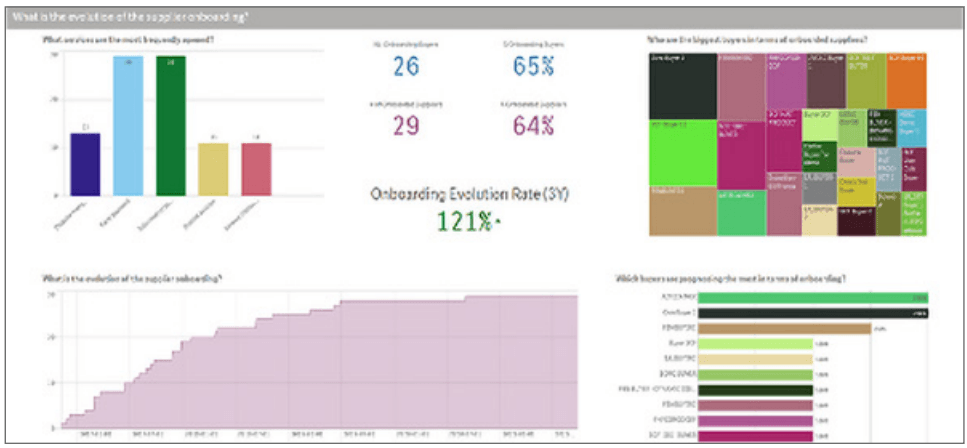

SCF Analytics

- What is my supplier participation rate?

- How many documents have been uploaded?

- Which invoices are financed?

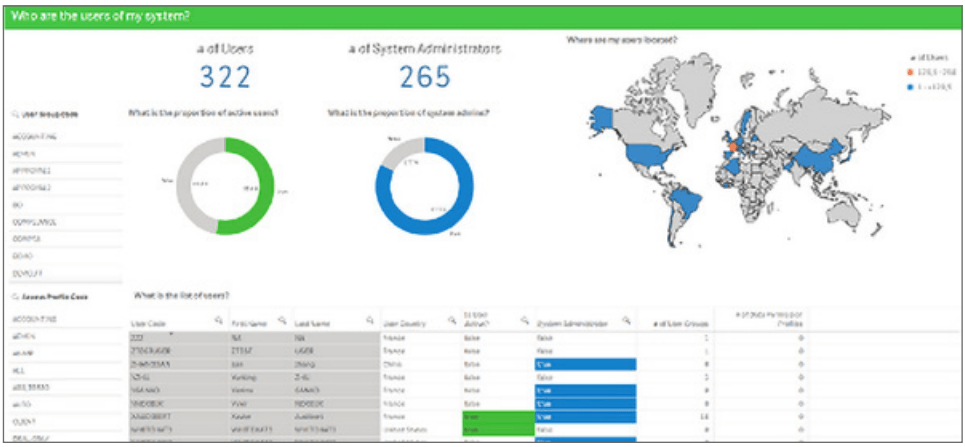

Compliance Analytics

- Who are the users and where are they located?

- Which modules can they access with which rights?

- What data can they access?