Research

Hackett Group: A Strategic Approach to Managing Corporate Liquidity

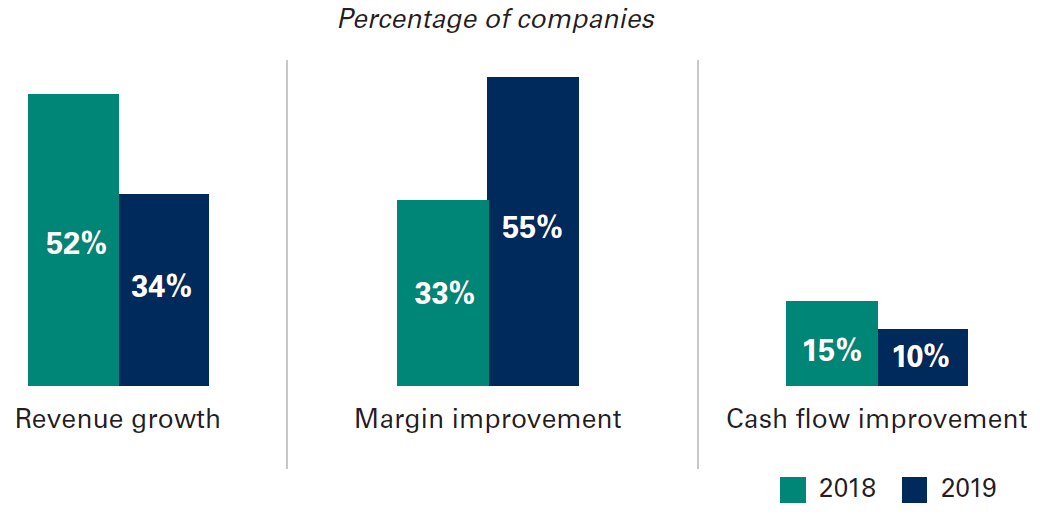

After a decade of uninterrupted economic expansion, this past summer saw a slowdown of growth in China and Europe, indications of a softer U.S. economy, the threat of protracted trade wars and a spike in energy prices. Together, these issues sent shivers through the financial markets and put a dent in corporate earnings. Given that the CFO’s job is to optimize enterprise financial performance in good times and bad, the shift in the business environment did not catch many by surprise. Foreseeing earnings pressures, financial executives identified margin improvement, not growth, as their company’s predominant financial objective for 2019, a big switch from 2018, when growth was top of mind (Fig. 1).1

FIG. 1 Top financial objective

Concerns about margin compression led companies and finance executives to emphasize cost reduction on their agendas for this year. In late 2018, when we asked finance executives which enterprise objectives they would be asked to support in 2019, 91% cited cost reduction, which was tied for first place with enterprise digital transformation. The two are closely related because many finance organizations consider cost optimization as the lead business driver of digitization. However, cost takeout alone will not support continued enterprise success. Today, the business landscape is changing at an unmatched speed and giving birth to entirely new types of competition. Low cost cannot be the goal if it is achieved at the expense of product and service innovation.

Today, low cost cannot be the goal if it is achieved at the expense of product and service innovation.

Table of Contents

The Four Ingredients of Strategic Liquidity Management

Finance organizations can enable companies to straddle the two seemingly contradictory objectives of cost management and innovation. While they continue to support costreduction initiatives, they can also activate an often-underutilized asset – corporate cash – to fund continued investment while keeping borrowing costs down, improving the planning process, and more effectively protecting the company’s assets and revenues from financial risk.

The strategic management of liquidity is comprised of four critical elements:

- Assigning end-to-end process ownership to orchestrate the flow of information across businesses, functions and processes.

- Creating 100% real-time visibility into current and expected cash across processes such as treasury management, accounts receivable (AR) and accounts payable (AP).

- Enhancing assets and revenue protection through better exposure identification and risk management.

- Integrating payment processes to improve coordination among functions and standardize fraud prevention and detection.

Assigning end-to-end process ownership

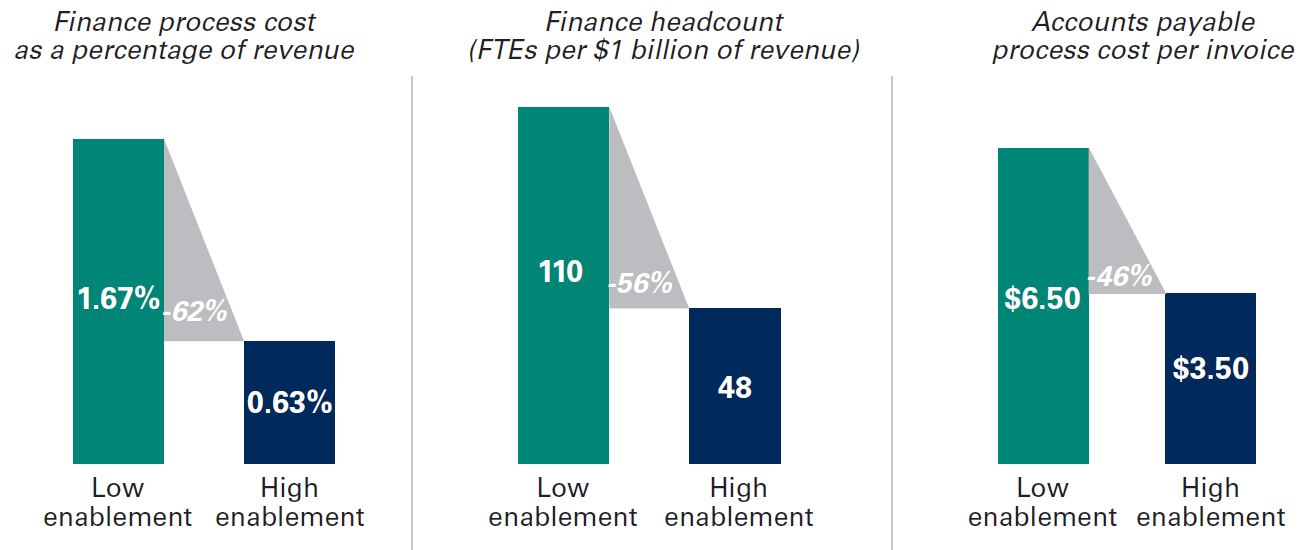

A holistic approach to managing liquidity, which combines upstream and downstream process elements across different areas in the company, requires a designated process owner. Otherwise, there is no clear accountability. In study after study, we have found that end-to-end process ownership is associated with greater process efficiency and effectiveness. For example, finance organizations with a higher degree of end-to-end process ownership (i.e., dubbed “enablement” in Fig. 2) spend 62% less on the overall finance process compared to ones with a lower level of end-to-end process ownership. The same is true for headcount and AP process costs, which are both significantly lower.

FIG. 2 Outperformance due to end-to-end process ownership: Efficiency

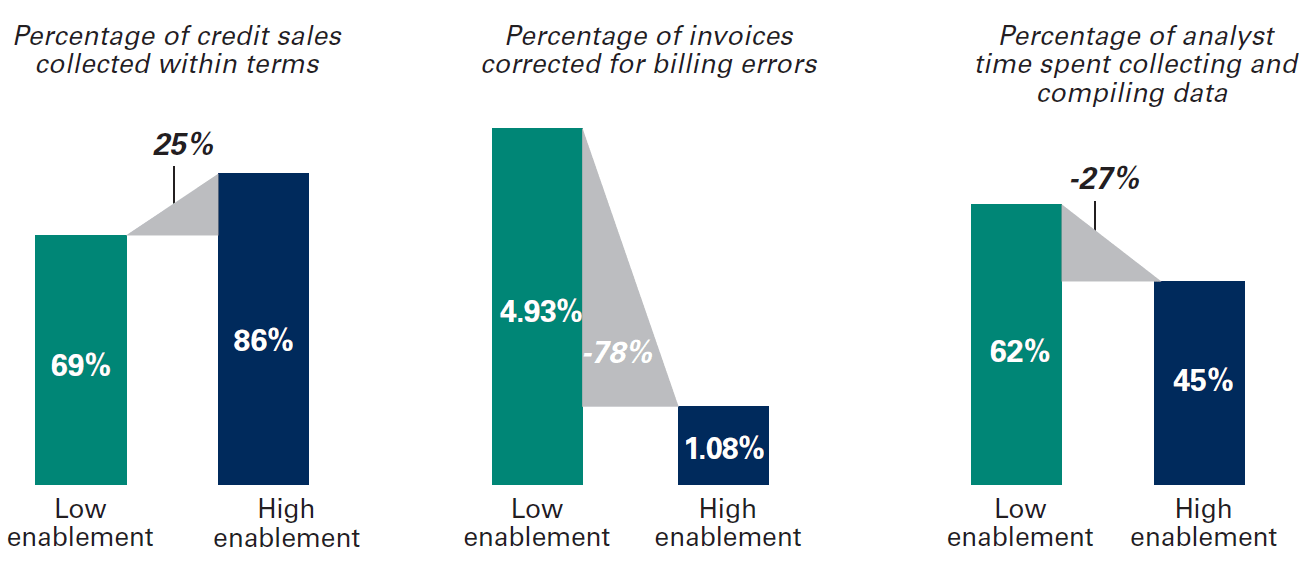

End-to-end process ownership also cuts through information silos and reduces error rates and the amount of time analysts have to spend collecting and compiling data, while increasing the quality of the receivables portfolio. (Fig. 3).

FIG. 3 Outperformance due to end-to-end process ownership: Effectiveness

Treasury is the most qualified department to assume the end-to-end ownership of the strategic liquidity management process. It already runs the cash management process and is electronically networked into the company’s financial ecosystem (e.g., banks and payment systems). Treasury also controls bank relationships and bank accounts. It can therefore leverage existing connectivity and account-structure oversight to achieve economies of scale in channeling all cash flows through a smaller group of providers, reducing settlement risk, and significantly lowering bank fees and transaction costs.

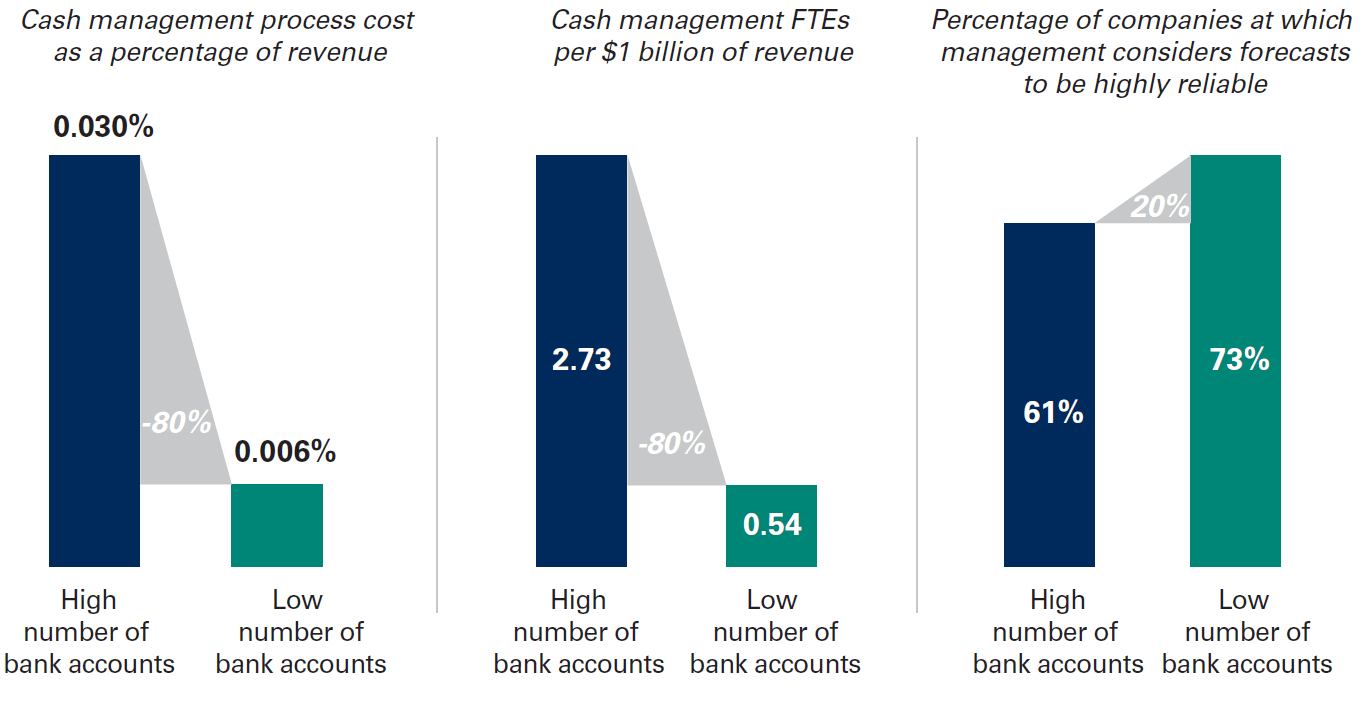

By simplifying the global account structure, treasury can materially affect its process cost and effectiveness. Our analysis shows a strong correlation between the number of accounts and treasury process performance (Fig. 4). Cash-management cost and headcount are vastly lower at companies with fewer bank accounts, because it takes less time to establish the company’s cash position, transfer funds and pool liquidity for short- and long-term investment. Organizations with a lower number of bank accounts are also more effective: They produce better forecasts and are therefore 20% more likely to be perceived by management as highly reliable.

FIG. 4 The effects of bank account proliferation on finance performance

Creating 100% real-time information transparency

Complete visibility into all incoming and outgoing cash is a prerequisite for active management of liquidity. Without information about where cash is trapped and how much cash is scheduled to be received or paid out, treasury cannot paint a dynamic picture of the company’s global cash position. Consequently, it is unable to generate accurate reports or produce timely forecasts that provide management with insight to support resource allocation decisions.

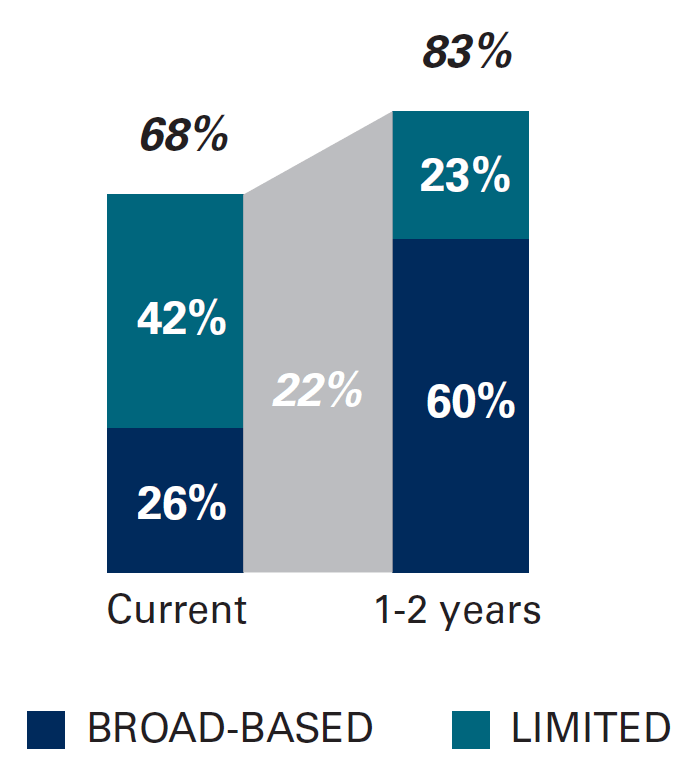

Achieving such transparency can be a formidable challenge when data is stored in disparate source systems. Most finance organizations still operate in a fractured core system environment.² Full system consolidation is expensive and can take a very long time, but there’s no need to wait. Modern data management architectures and cloudbased treasury management systems can dismantle information silos in order to provide greater accessibility to company-wide data. As a result, treasury can monitor and control the flow of cash regardless of the “pipeline.” Our research shows that finance currently runs 68% of its applications in the cloud, a level that executives anticipate will rise to 83% over the next 12-14 months (Fig. 5).

FIG. 5 Cloud-based application adoption rates

Complete cash transparency gives treasury a clear line of sight into such details as the number of days payables outstanding (DPO) and days sales outstanding (DSO), so it can detect payment patterns and predict the aging of the receivables portfolio. As a result, treasury can greatly improve the accuracy of the cash forecast. For example, if a forecast is based on last year’s DSO (e.g., 30 days), but customers are actually paying in 45 days, the forecast will be off the mark. By continually updating the underlying forecast assumptions, treasury can more effectively support business planning decisions and offer more meaningful guidance to AP and AR on altering payment terms in order to meet established payment policies and improve the health of the receivables portfolio.

Enhancing assets and revenue protection

Correctly identifying the company’s exposure to fluctuations in currency markets has been a perennial challenge for treasury teams. An accurate view of current and anticipated risk is essential to insulating corporate earnings. Traditionally, treasury’s ability to capture the full extent of net exposures has been hampered by unreliable cash forecasts and incomplete visibility into sources of cash. If treasury hedges too much or too little, the difference between the value of the hedge instrument and the underlying exposure is captured in the FX gain/loss line of the income statement. This is particularly important during periods when the dollar is strong, because that means foreign-currencydenominated revenue will translate into fewer dollars when companies report results at quarter-end.

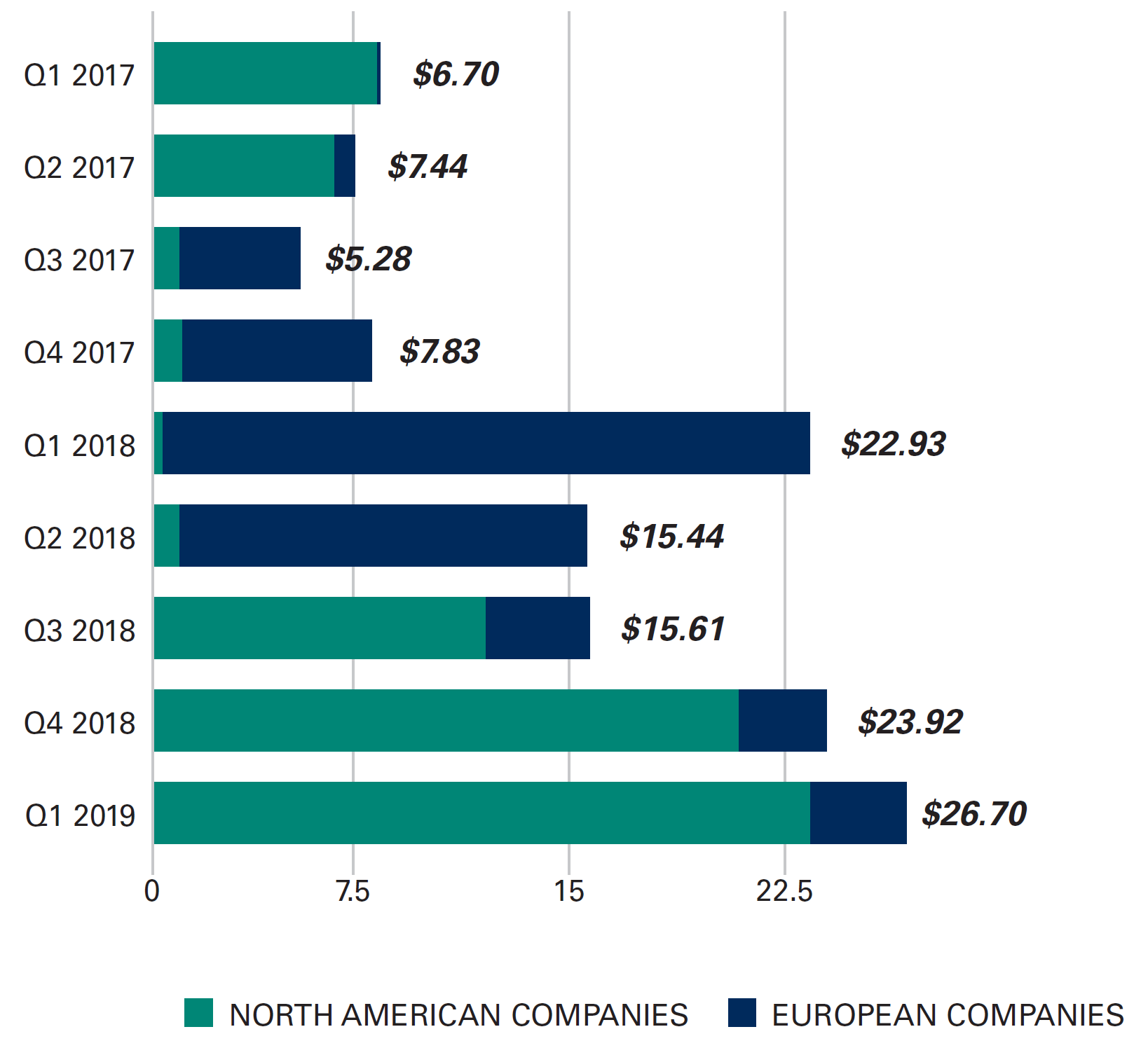

Investor nervousness about a global economic slowdown, a protracted trade war with China and potential geopolitical shocks bolstered the dollar during the last quarter of 2018 and the first quarter of this year. U.S. assets are the traditional safe haven when markets are in turmoil. Kyriba, a vendor of a cloud-based treasury systems, calculates that a stronger dollar took a $26.70 billion bite out of U.S. and European companies’ earnings in the first quarter of 2019, and $23.92 billion in the last quarter of 2018; North American companies bore the brunt of the hit (Fig. 6). Better visibility into their FX exposures would permit companies to better manage their risks, and alleviate the negative effects of currency gyrations by setting a threshold rate for the translated value of FX-denominated revenues. While GAAP rules forbid companies from hedging earnings outright, cash flows are a good proxy. And a reliable view into the timing and magnitude of anticipated cash flows enables treasury to fine-tune its FX risk management program.

FIG. 6 Quantified negative impact of FX change ($ billions)

Integrating payment processes

A critical enabler of strategic management of liquidity is the integration of financial and commercial payment flows. Consolidating this information not only improves visibility but ensures that everyone follows the same rules, so payment instructions are consistent, and fraud is easier to prevent and detect (see sidebar). By merging financial and commercial payment processes through a comprehensive liquidity management program, treasury can better orchestrate the interaction between AP and AR, becoming the glue that bonds the purchase-to-pay and customer-to-cash processes. In this role, treasury needs to work with both sides of the payment flow to determine optimum payment terms, analyze the tradeoffs of offering or taking advantage of discounts, and apply advanced analytics to evaluate customer credit quality. The latter is especially important as the economy downshifts.

For example, treasury should work with purchase-to-pay process leaders to determine the right mix of payment terms to fit the company’s unique situation. Simply standardizing terms will not do, given industry and supply-chain disparities, so treasury must consider all moving parts and dependencies. In addition, companies that borrow funds to pay vendors must weigh the cost of borrowing against the benefit of taking the discount. Treasury should also calculate the right net payment terms (longer terms mean the company gets to hold onto cash longer as working capital) by taking into consideration the financial standing of its suppliers. In response to the current economic environment, buyers have been aggressively lengthening their payment terms, so a one-size-fits-all approach significantly increases supplier risk. Further, pushing critical and sensitive suppliers into financial distress can have serious repercussions for the buyer’s operations and reputation.

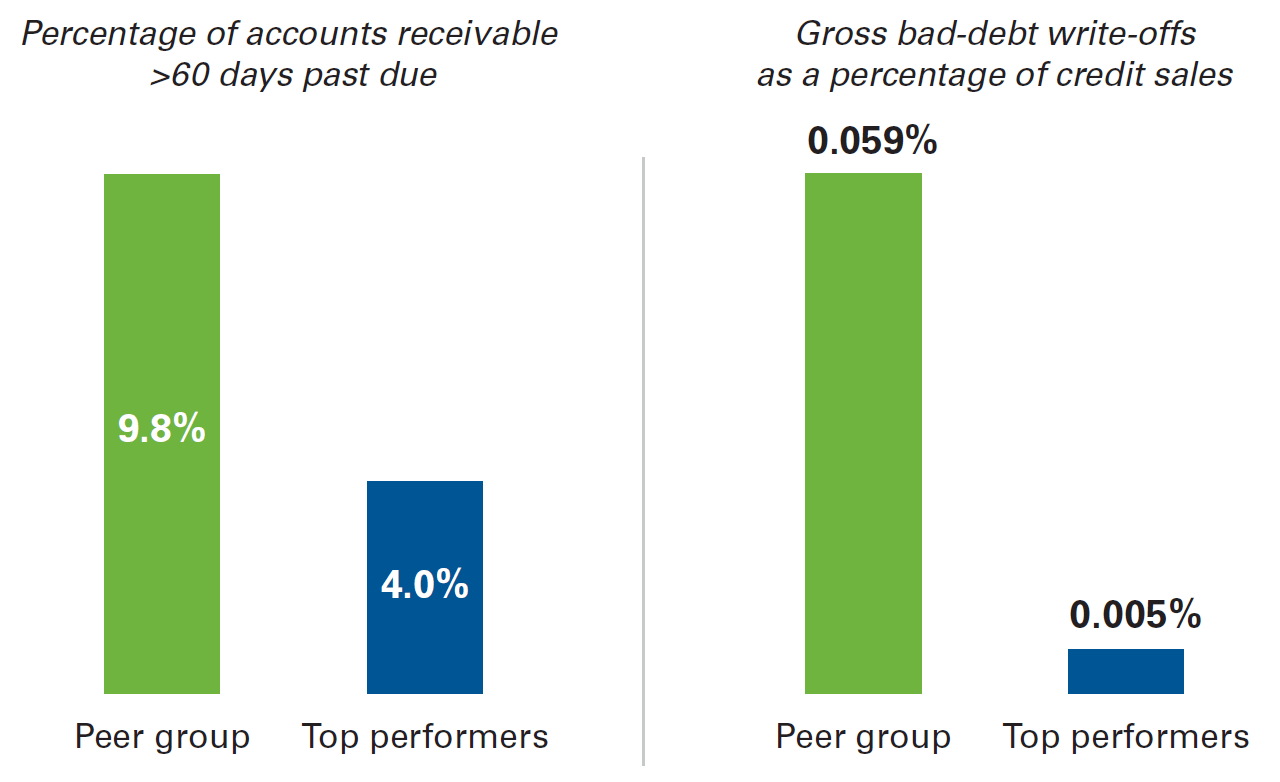

At the same time, treasury should establish robust customer-credit review policies and procedures to prevent negative effects on the health of the receivables portfolio and thus working capital. Fig. 7 illustrates the wide difference in the quality of the receivables portfolio between organizations with top-performing customer-to-cash processes and more typical organizations (i.e., the “peer group”). Compared to top performers, peergroup organizations have more than double the percentage of receivables that are more than 60 days past due, and nearly 12 times higher gross bad-debt write-offs as a percentage of credit sales.

FIG. 7 Leading indicators of receivables portfolio health

Conclusion and Recommendations

By more actively managing enterprise liquidity, treasury can complement costcutting efforts with a growth-oriented approach that leverages financial assets to fund continued investment and support the company’s competitive advantage. Access to cross-enterprise data and availability of integrated payment processes also helps treasury partner more effectively with internal stakeholders, as it elevates the quality of conversations among treasury, purchase-to-pay and customer-to-cash. To embrace an active approach to liquidity management:

- Broaden the mandate of treasury and assign clear process ownership: Strategic management of corporate liquidity is as much a change in mindset as a change in process. It requires close collaboration among several departments and a willingness to change the way things have always been done. Designate treasury as the agent of change and orchestrator of the new, holistic approach, with accountability not only for running the new process but also getting broad business buy-in.

- Dismantle data silos: Before treasury can manage liquidity as a corporate asset, it must have a clear line of sight into current and expected cash everywhere in the company. Without a granular level of information, it cannot develop reliable cash forecasts, which are critical for making decisions on how to fund the business and insulate it from foreign-currency risk. Adopt cloud-based systems and data platforms to unclog the information pipeline and store data in a single, easily accessible repository.

- Combine payment processes: Bringing all payment processes under the same roof allows treasury to build a strong link between AP and AR, and align policies and strategies with the company’s overall liquidity requirements. By standardizing processes, treasury can also better monitor and enforce fraud prevention and detection policies. Integrate financial and commercial payments and apply strong, consistent controls to both by leveraging cloud-based solutions and AI/cognitive computing to spot and stop suspicious activities.

Related Hackett Group Research

How CFOs Can Mitigate the Risk of Payment Fraud, March 2019

The CFO as Chief Growth Officer, July 2018

Becoming a Leading Treasury Organization, Part 1: Treasury Is Playing a More Strategic Role in the Enterprise, August 2017