eBook

Five Questions Every Modern CFO Should Ask to Maximize Growth

In the dynamic and rapidly evolving business landscape, the role of a Chief Financial Officer (CFO) has transformed from a traditional financial controller to a strategic driver of growth. Today, CFOs are expected to go beyond accurate financial reporting and financial controls, actively contributing to organizational strategy, talent management, technology adoption and financial policies.

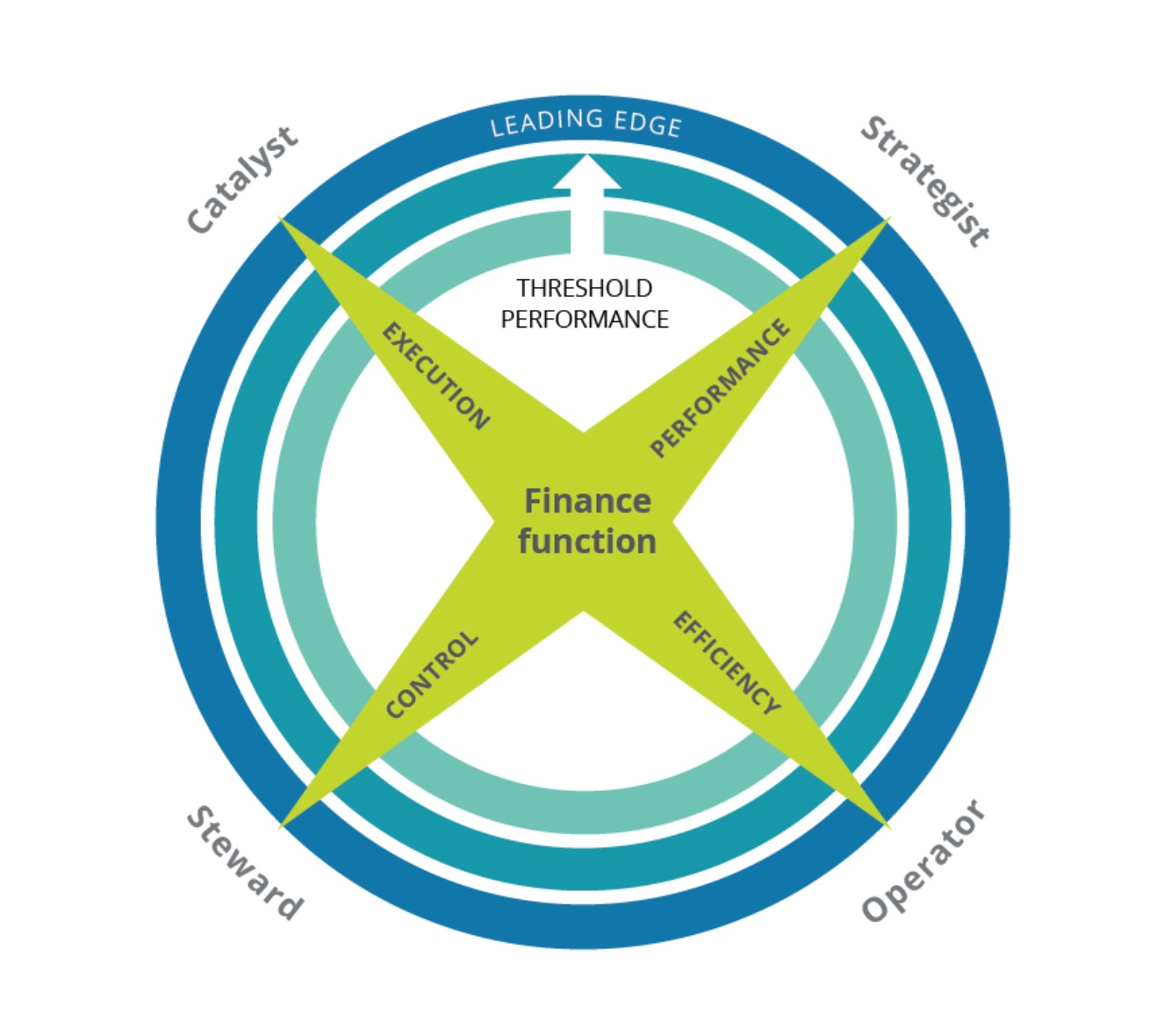

In one of their Perspectives articles, Deloitte published a framework of “Four Faces of the CFO”. The framework states that modern CFOs are expected to play four diverse and challenging roles. The two traditional roles are “steward”, preserving the assets of the organization by minimizing risk and getting the books right, and “operator”, running a tight finance operation that is efficient and effective. Meanwhile, today’s CFOs also need to be “strategists”, helping to shape overall strategy and direction, and “catalysts”, instilling a financial approach and mind set throughout the organization to help other parts of the business perform and grow. These varied roles make a CFO’s job more complex than ever.

Underpinning a CFO’s tactical and strategic decision-making role is information. The ability to access data from many systems in real time is widespread, but ensuring the optimization of the quality and completeness of that data for decision-making remains a constant challenge. To thrive in this changing environment, modern CFOs must ask themselves critical questions to unlock the full potential of their organizations and maximize growth. In this ebook, we will delve into the five key questions every modern CFO should ask to chart a path towards sustainable growth.

Table of Contents

Do I Need 100 Percent Visibility?

This question goes beyond a mere reporting exercise, as the lack of global visibility over cash and risk has a direct impact on earnings, profitability and competitiveness.

In today’s digital age, the use of smartphones, tablets and advanced data visualization tools has given the impression that we have achieved a comprehensive understanding of cash and risk on a global scale. Many CFOs have access to reasonably accurate information about their organizations’ positions in major currencies and traditional markets.

However, relying upon the ‘80:20’ rule, where 80 percent of outcomes might be good enough for making an informed decision, is no longer a viable business approach. In a world marked by globalization, market volatility and new growth dynamics, what used to be the remaining 20 percent of information is now rapidly increasing, in some cases, to 25 or 30 percent or even more. Previously overlooked markets, once deemed less significant, are now emerging as key drivers of growth in many cases. Consequently, a complete view over cash and risk is imperative, as it not only encompasses the relatively easier 80 percent, but also extends across the entire 100 percent of balances and exposures.

Without this comprehensive perspective, it is increasingly challenging to make well-informed, reliable strategic and operational decisions with confidence. In order to thrive in the current business landscape, organizations must go the extra mile and ensure they have a holistic understanding of cash and risk across all relevant dimensions.

It’s not just about the visibility, it’s what you do with this data that matters.”

—Frédéric Marret, Group CFO, Webcor Group

How Does My Finance Function Compete?

The absence of visibility into surplus cash balances and their availability to fund deficits in other areas of the business can indeed lead to increased borrowing costs. For large multinational corporations, with easier access to the borrowing markets and the ability to benefit from low interest rates in many currencies, this issue might not appear significant on the surface. However, even for these large entities, maintaining efficient cash management practices is pivotal to ensure a healthy balance sheet and optimal financial performance, not to mention the fact that interest rates have been rising rapidly in all major global markets.

What many businesses overlook is the opportunity cost of not leveraging their surplus cash balances efficiently. Cash that sits idle in a bank account is not just dormant, it is potentially losing value due to inflation and missing out on potential earning opportunities that could be realized through investments or by reducing existing liabilities.

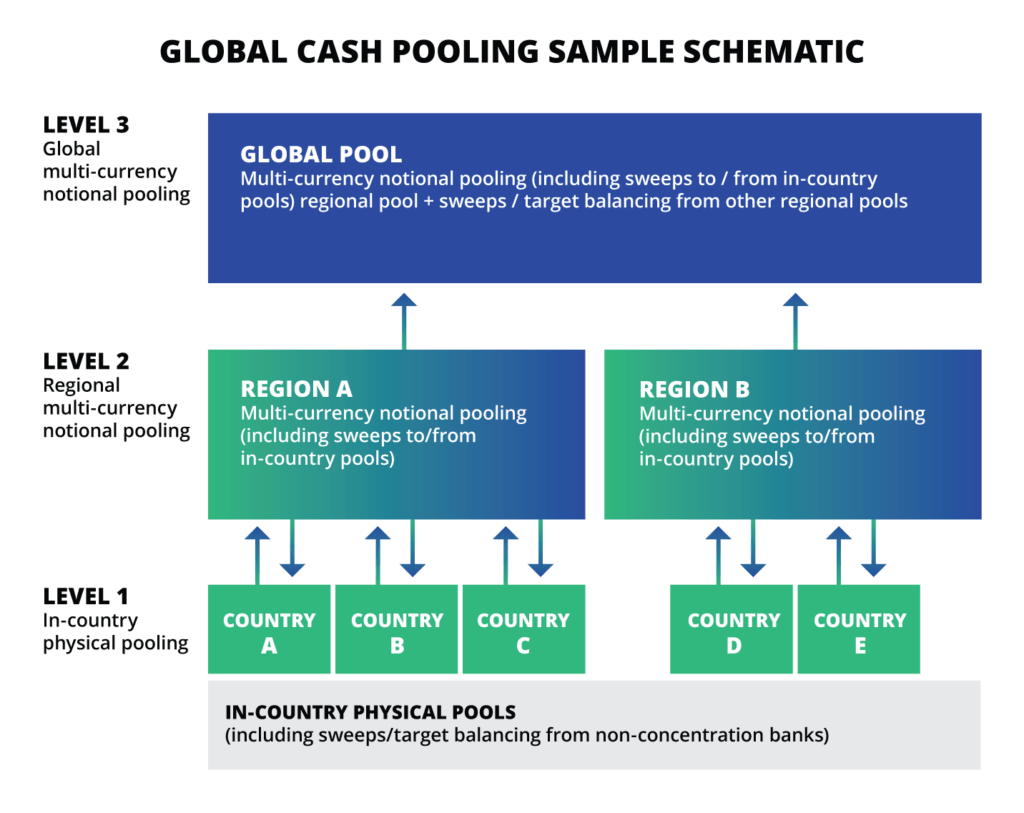

One of the ways companies can avoid this pitfall is by practicing effective cash pooling. Cash pooling is a strategy that enables companies to balance their cash across different accounts, so as to reduce the need for borrowing. It involves combining the credit and debit positions of several accounts into a single account to optimize the interest outcome. By using this method, companies can ensure that their surplus cash is being utilized to fund deficits in other areas of their business, thus reducing borrowing costs.

However, the competitive landscape in the financial function gets even more intricate when we look beyond multinational corporations. Mid-size businesses, for example, often encounter greater difficulties in securing bank loans due to their relatively smaller scale and less established credit histories. Under such circumstances, maintaining adequate liquidity for operational needs while ensuring that surplus cash is being optimally used becomes a challenging balancing act.

Am I Managing Risk, or Is Risk Managing Me?

The importance of efficient financial risk management, including foreign currency risk, underscores the need for complete visibility. Even large corporations equipped with skilled and well-resourced treasury departments and sophisticated treasury systems have experienced significant earnings reductions due to FX volatility. These losses not only result in financial repercussions, but also damage the company’s reputation, ultimately impacting its share price.

Achieving 100 percent visibility over exposures extends beyond hedging 100 percent of those exposures. Instead, it empowers CFOs and treasurers with comprehensive information, enabling them to manage these risks in alignment with the company’s risk policy. By having access to complete data, they can make more informed decisions and implement risk management strategies that mitigate potential losses and safeguard the organization’s financial stability.

Am I Gaining Value from ‘Trapped’ Cash?

‘Trapped’ cash, i.e., funds that cannot be exchanged or transferred cross-border, poses a challenge for companies operating in highly regulated markets. It is important to recognize that the visibility over these balances is just as significant as managing cash in more accessible currencies or countries.

Many CFOs recognize the issue of ‘trapped’ cash; however, they often overlook the possibility of connecting this cash into a notional pool or interest optimization arrangement to offset deficits at a regional level. Staying informed about evolving regulations that can change the restrictions on the exchange or transfer of funds is crucial.

There may also be opportunities to leverage in-country balances more effectively, such as funding liabilities or financing growth. Additionally, statistics show that interest rates in certain countries and currencies often outperform those of more readily tradable currencies, presenting the potential to generate higher yields that can be reinvested to drive further growth.

The current interest rate environment plays a crucial role in unlocking the value of trapped cash. As highlighted in Deloitte’s Working Capital Roundup report, interest rates have been on the rise after a historically low period. The Federal Reserve has implemented multiple rate increases since March 2022, resulting in the highest levels seen in more than 15 years. This shift not only amplifies the relative value of trapped balance-sheet cash, but also redefines the business case for operational transformations aimed at releasing additional working capital. With the growing burden of increased interest expenses, companies are now even more focused on minimizing additional borrowing and leveraging trapped cash as an alternative source of funds.

Free cash flow was essentially life or death. From a corporate standpoint, we had to get this right.”

—Nathan Lorton, SVP & CFO, Feld Entertainment

Could the Business Be Worth More?

In the realm of mergers and acquisitions (M&A) as well as divestments, corporations are increasingly tapping into global markets, aiming not only for revenue growth but also for strategic expansion and diversification. M&A deals can unlock immense value by leveraging financial and operational synergies, such as streamlining processes, reducing redundancy and expanding market reach.

However, the process of merging businesses, particularly those with diverse organizational structures, disparate technologies and different reporting mechanisms, is an intricate task. A misstep could lead to value leakage. For instance, if the integration of systems and harmonization of information flows are not well planned and executed, the anticipated value from the acquisition can significantly erode.

Conversely, when considering a divestment, a comprehensive understanding of the business’s assets, including cash reserves, is crucial in accurately determining its value. Uncertainty over financial elements can often lead to a conservative valuation, as finance executives prefer to err on the side of caution. However, this approach might undervalue the business, leading to potential value loss during a sale.

What Is Your Answer to the Questions?

In an ever-changing, increasingly complex global business environment, there’s no ‘one size fits all’ answer to these questions. What matters is your capacity to use these introspections as a catalyst for change and adaptation.

- Maximizing visibility over cash and risk is no longer an option; it’s a necessity for strategic and tactical decision making.

- In the competitive financial arena, leveraging surplus cash and practicing effective cash pooling can make all the difference.

- Proactively managing risk rather than being governed by it can significantly enhance your business’s financial stability.

- Understanding how to unlock value from ‘trapped’ cash and exploring unconventional ways to use it can add to your financial prowess.

- Recognizing the potential value in M&As, divestments and growth markets, even amidst complexities and uncertainties, can redefine your strategic direction.

As you reflect on these questions, remember, it’s not just about finding the answers; it’s about taking actions. Leveraging advanced tech tools can significantly enhance data collection and analysis, optimize financial controls, streamline operations and foster informed decision-making. Remember, the digital revolution is not just about keeping pace with the times. It’s about harnessing this power to redefine the role of the modern CFO and position the finance function as a strategic driver of growth.