Blog

What is a Payments Hub – and Why Do I Need One?

According to the 2021 AFP® Payments Fraud and Control Survey Report, 90% of treasury teams see payments fraud as the same or worse than last year’s, which was already a historic record of fraud incidents. Many times treasury and finance are directly affected, because their payments were compromised, while other times, the treasurer is pulled into the conversation to fix whatever vulnerability was exploited for someone else’s payment.

Regardless of how or why, treasury is being asked to provide better payments solutions by the CFO, CIO and CISO. A payment management system or “a payments hub” provide that answer, in that they offer the global visibility and standardized controls that are so necessary to ensure that every payment is handled in a consistent manner regardless of geography, payment type or who requested it.

What is a Payments Hub?

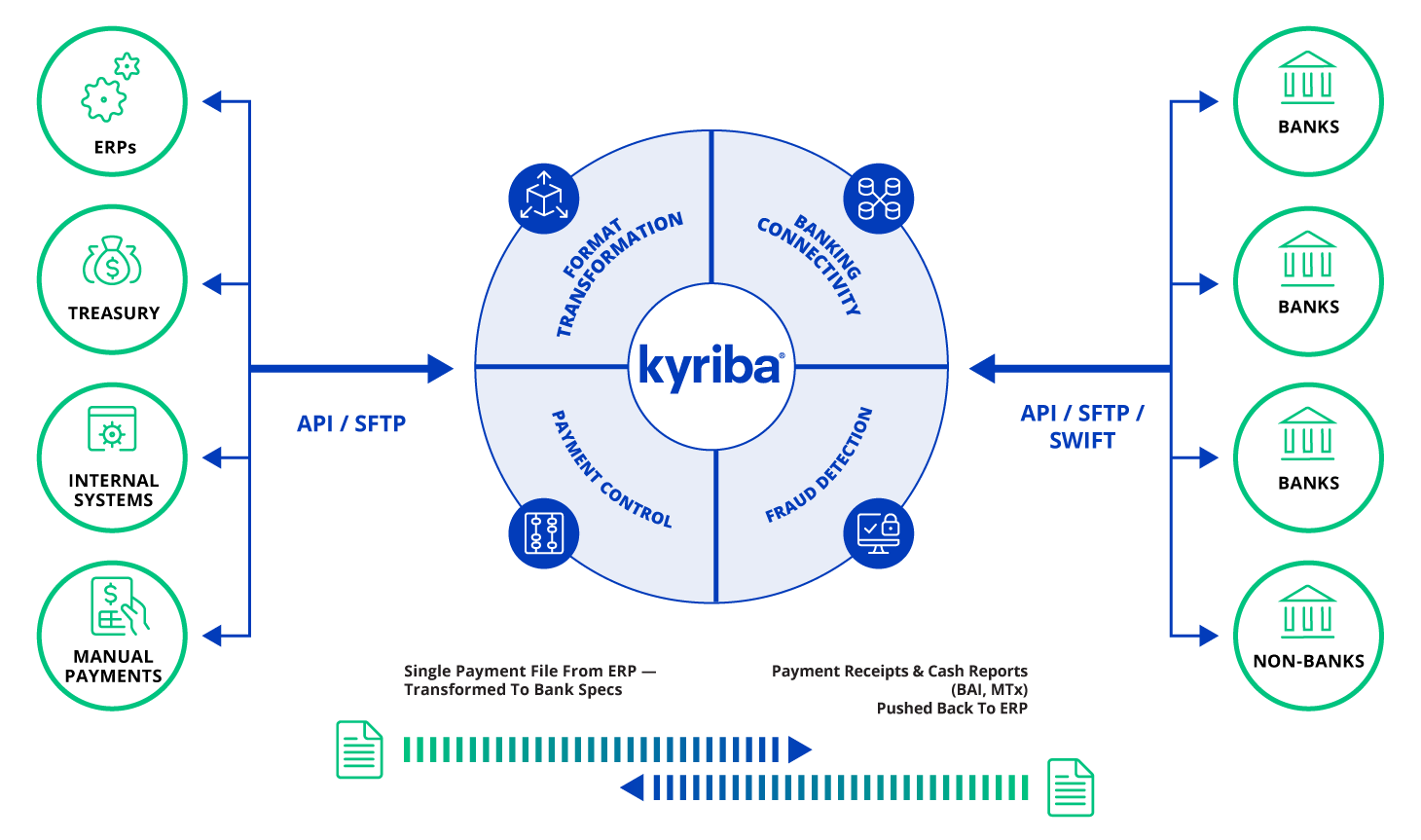

A payments hub ensures that payment workflows comply with the organization’s payment policy. This is why CIOs are demanding that their corporate payments hubs (depicted below) be implemented and are often asking treasury to take charge.

What a payments hub should look like – Here’s a graphical representation of what your corporate payment systems could attain, to include external inputs, key functions, payment types, connectivity and more.

Benefits of a Payments Hub:

When treasury does lead the initiative for a payments hub, they found the following benefits, which enable the organization to gain both cost efficiency and operational security.

Standardization

The key to eliminating unauthorized payments – even if accidental in nature – is to ensure a standardized set of controls that prevail without exception. Controls could include payment approval scenarios, extra layers of authentication, procedures if approvers are remote and/or unavailable, and specific actions if modifications to the payment are required. The organization’s payment policy should be digitized and enforced by the payment hub software to ensure these controls are consistently applied.

Payment Screening

Many organizations require payments to be screened against sanctions lists prior to sending those instructions to the bank. While this is a good practice, screening should not stop there. Payment scenarios – e.g. payments being made outside of approved countries, first payment to a new bank account, irregular payment amounts, etc. – should also be screened in real-time so that any suspicious payments can be stopped and quarantined in real-time to be reviewed by authorized reviewers.

As payments continue to diversify across multiple channels (e.g. wires, ACH, checks, B2P, blockchain) and become more real-time, organizations cannot rely on treasury staff scanning every payment in real-time; nor can they expect their banks to be the last line of defense. More sophisticated solutions including robotic process automation (RPA), should be leveraged to provide the best possible protection. Fortunately, such solutions are available within most payments hubs.

Visibility

Many treasury teams struggle with having complete transparency into all outgoing payments before they happen. This issue magnifies as organizations also adopt new request for payment strategies to improve collections. Treasury isn’t learning about payment activity early enough to make effective cash and working capital decisions.

Payment hubs, through the consolidation of all payment activity, can provide that visibility to treasury so they can be certain about what payments need to be funded. With this added level of precision, working capital can be reduced and a greater percentage of total cash reserves can be deployed to meet organizational KPIs. In many cases, this may directly affect the CFO and Treasurer’s bonus attainment.

Cost Saving

Not lost in the myriad of benefits is the fact that payment hubs reduce the cost of managing payments. There are several different ways:

- IT no longer has to manage bank connectivity

- IT outsources development and maintenance of bank payment formats

- Multiple systems that previously sent payments to banks can be consolidated down to one

- Treasury can optimize banking services and remove duplication caused by the multitude of systems (including treasury and ERPs) that connected to the banks.

Certainly reducing IT’s role in bank connectivity will save hundreds of thousands to millions of dollars, especially when considering the banking industry’s harmonization of bank formats to ISO20022 XML. This initiative, alongside bank’s movement to APIs, would mean years of re-development by IT teams to rebuild protocols and formats from the ERP to bank. Payment hubs make this a non-issue, slashing costs while simultaneously eliminating time to market bottlenecks.

While fraud prevention is almost always the driving reason behind payments hubs adoption, other benefits including visibility, standardization, time to market, and cost reduction should not be overlooked as these features will likely pay for the payments hub with a lightning quick ROI. If you are interested in learning more about payment optimization and how Kyriba can support your organization, request a demo and see how Kyriba’s Payments Hub solution works in action.