Blog

Securing High, Risk-Free Returns with Dynamic Discounting

While treasurers have traditionally had the remit of being a safe guardian of corporate cash, anybody who has worked in the industry knows that treasury’s remit has moved from being a cost center to a value generator. The increased visibility in cash balances and forecasts brought about by greater use of treasury management systems has facilitated this, enabling idle cash to be minimized and free cash allotted to pay down debt. Beyond faster debt repayment, there are now several options which can generate more value for the organization without requiring an unnecessary element of risk to be introduced.

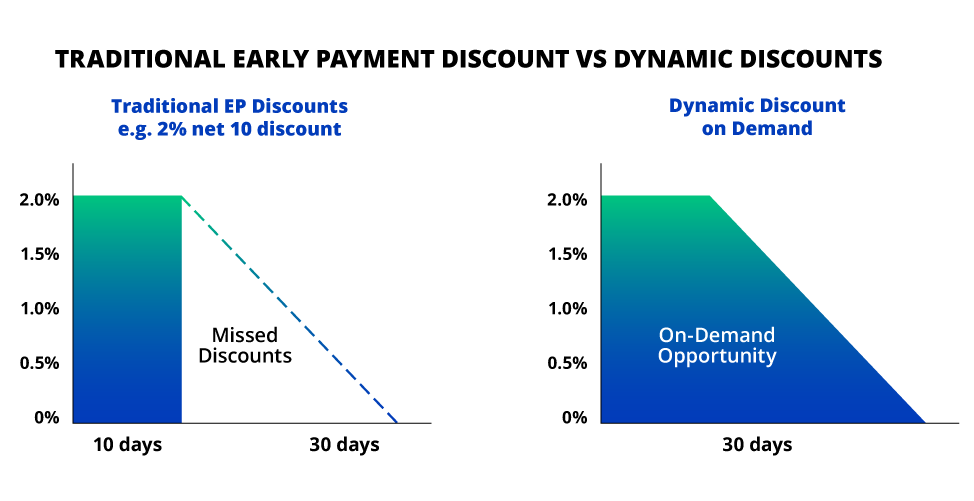

One of these solutions, which treasury has had limited input to date, is leveraging free cash to secure early payment discounts. As many people know, early payment discount programs enable buyers to generate high returns on free cash. Traditional 2/10 net 30 programs provide the equivalent to a 36% annual return – risk-free. However, these early payment programs give an “all or nothing” discount, so if the buyer is unable or unwilling to process payments in less than 10 days, it has no incentive to make payments any earlier than the due date.

Dynamic discounting is a buyer-led program that gives organizations the option to pay their suppliers early (at a time of the buyer’s choosing), in return for a discount on the invoice value. It offers greater flexibility than standard payment discount programs, by providing a pre-agreed sliding scale discount which moves toward zero as the payment moves towards its due date. This enables the buyer to choose a payment date which fits both its ability to process payments in a timely manner, and its availability of free cash. As an additional option, suppliers can also be invited to bid a discount level on their invoices and get paid immediately. The diagram below outlines how dynamic discounting differs from traditional programs.

Dynamic discounting programs offer flexibility on both sides – sellers can choose which invoices to enter into the dynamic discounting platform based on their need for rapid cash and buyers can pay at a time that is most suited to their organization’s needs. These programs offer significant value to both sides of the supply chain.

While dynamic discounting is not an entirely new phenomenon, one area that could improve its adoption is removing the disconnect between procurement and treasury. Although larger cash-rich companies may have the funds to pay all invoices early, others may need to make individual early payment decisions based on their free cash flow, and therefore this on-demand visibility can be critical for a successful program.

Implementing both a treasury management system and a dynamic discounting platform eliminates this disconnect and can provide the visibility required to make rapid decisions and secure the maximum discounts available. Customers can go through a single technology implementation and be technology ready to press a “pay me now” button for either themselves or their supplier community.

On the buyer’s side, these solutions provide the flexibility to either leverage free cash to pay invoices early as needed. On the vendor side, supply chain finance programs such as dynamic discounting provide the opportunity to speed up payments only when needed, ensuring optimal cash flow and reducing liquidity concerns.