Blog

A Spicy Volatility Stew Demands Liquidity Management

The combination of rising interest rates, inflation, and foreign exchange (FX) volatility has many treasury professionals uncertain about the future. While these factors make for a spicy volatility stew, effective liquidity management improves financial and operational results for multinational corporations today.

Volatility on the Rise

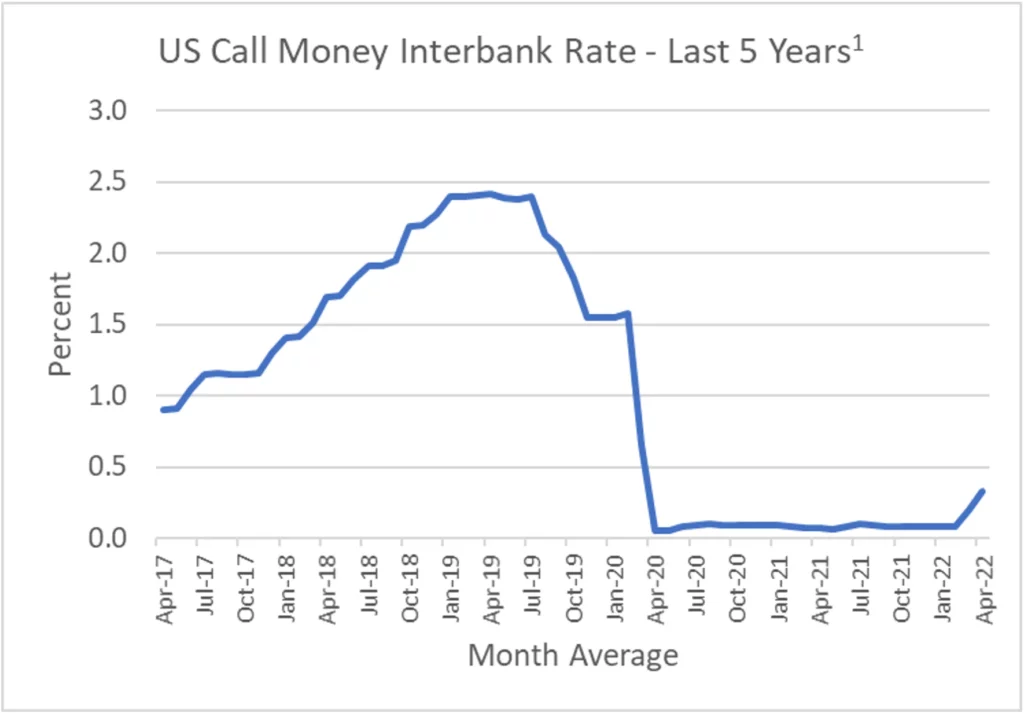

Most U.S. treasury professionals with less than 20 years of experience have enjoyed a long, mostly stable, period of low overnight borrowing rates. You have to go all the way back to 1960, where overnight rates averaged 0.61%, slightly above where they stand now in June 2022. Yet prior to 2000, the overnight borrowing rate averaged 6.51% – more than 10 times the current rate.

Most treasurers today experienced prolonged low rates from the 2008 Great Recession for about seven years. During that time, extremely low interest rates resulted in little opportunity cost for a company to leave cash balances in non-interest-bearing deposits.

Unless a company had the ability to reduce short-term borrowings or repay other debt, the incentive to move cash into a short-term investment was very low. Often bank earnings credits, based on average deposit balances, further reduced the opportunity cost of leaving cash in non-interest-bearing accounts.

The Federal Reserve is expected to increase the benchmark federal funds rate to 2.75% by the end of 2023. This will increase the significance of investing idle cash. However, for borrowers who can repay debt or avoid increasing external borrowing, the opportunity is even greater as borrowing rates are much greater than short-term investment rates.

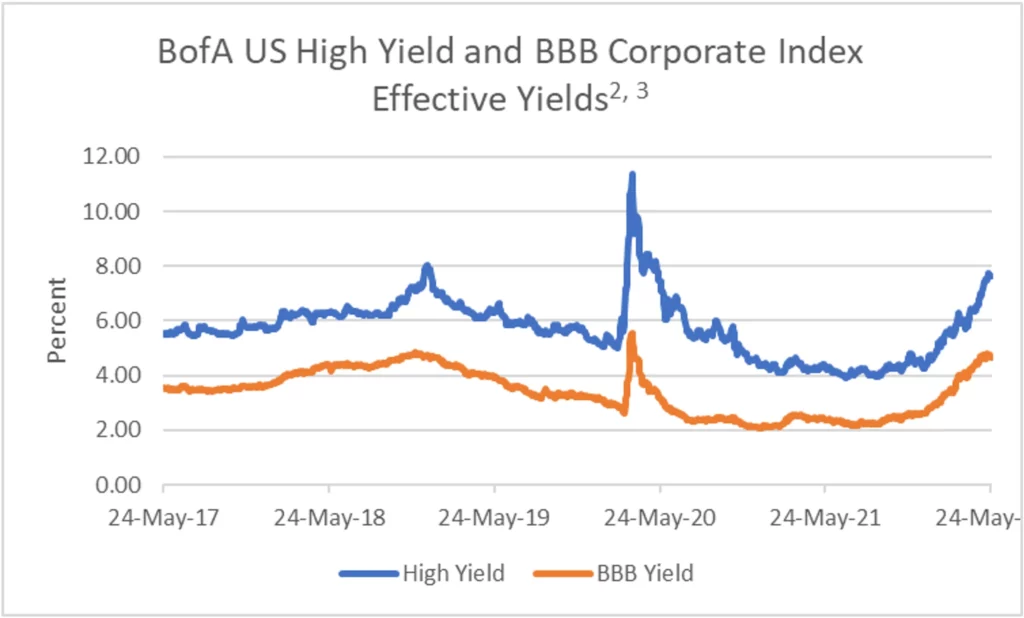

Prior to the COVID-19 pandemic, borrowing rates were trending lower as seen in both the High Yield Index and BBB investment grade bond indexes above. They rose sharply early on and remained above pre-pandemic levels until government stimulus and actions ensured credit availability. Borrowing rates declined steadily as a result, falling below the pre-pandemic level. But, rates have climbed steadily this year as inflation, economic concerns, supply chain issues, geopolitical conflict, and other destabilizing factors sharply increased borrowing costs.

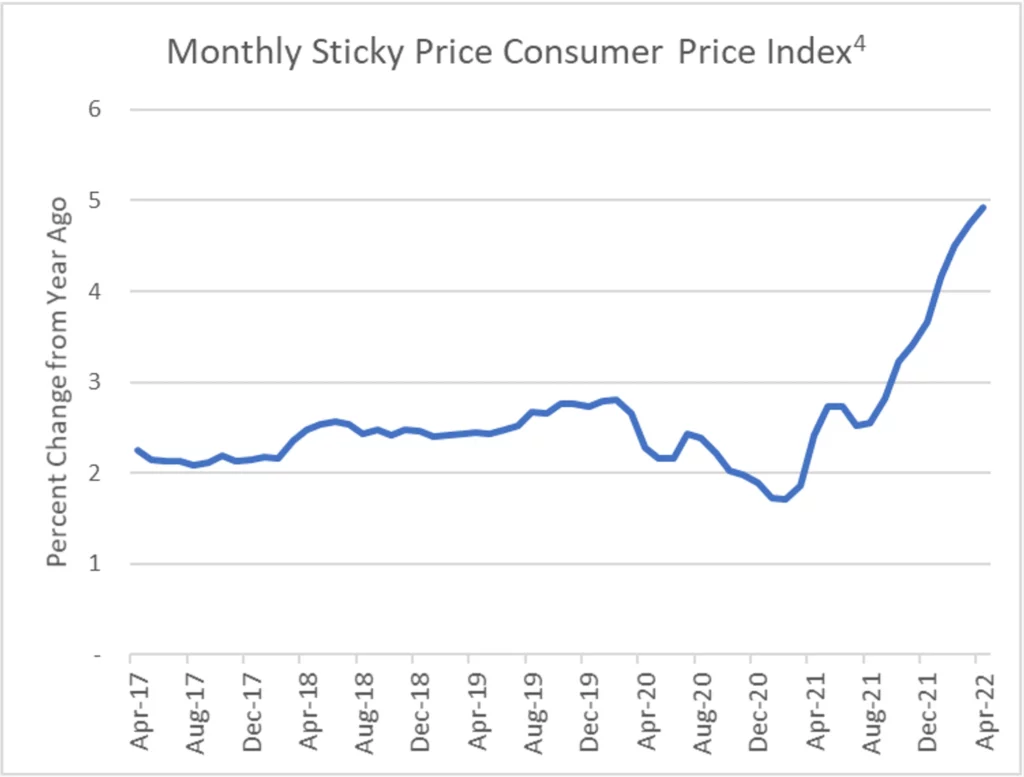

As mentioned earlier, the Federal Reserve is combating inflation by increasing interest rates. U.S. inflation has been accelerating since early 2021, having a negative impact on corporate earnings for most sectors of the economy, pressuring profitability. Inflation rates are now at levels that have not been experienced in decades. Lower profits will result in less cash to invest or reduce borrowing, increasing the importance that active, accurate and enterprise-wide liquidity management can have in offsetting the impact of inflation on cash generation. Earnings reports for the first quarter of 2022 by many sectors, particularly retail, have reported deteriorating margins, citing labor inflation, supply-chain disruptions, and increased costs as contributing factors.

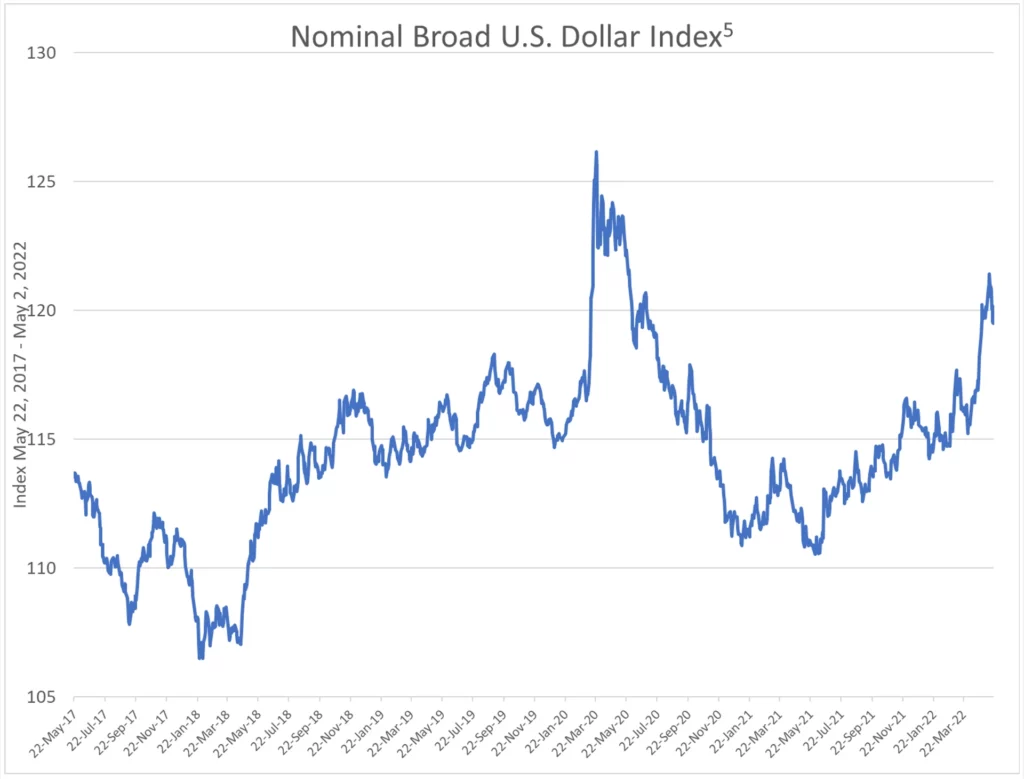

The third ingredient in the volatility stew is FX volatility impacts to the balance sheet and earnings. Most multinational corporations have direct exposure to foreign currency movements. The impacts of such volatility can be positive or negative, but the resulting impact and uncertainty in earnings is not desirable. Corporates typically strive to limit gains and losses from FX to as close to zero as possible, as uncertainty creates lack of confidence and that invariably impacts a company’s share price, borrowing costs and access to credit. Companies with well-managed FX hedging programs can mitigate such volatility, yet over or underhedged positions, intentional or unintentional, will not achieve the smooth earnings expected by investors.

The Nominal Broad U.S. Dollar Index (often referred to as the “Dixie” index) shows the U.S. dollar declining sharply following the brief COVID-19 recession and then steadily rising from mid-2021 against the trade-weighted basket of currencies in the index. Better economic performance, a flight to quality and more recently, rising interest rates, have strengthened the Dixie but with significant volatility over the last three years.

Ingredients to Reduce the Heat

The simultaneous increase in interest rates, inflation and FX volatility make for a strong liquidity stew, one that may lead to severe indigestion and lost sleep for many treasury professionals. It should be clear that complacency in cash management needs to be replaced by active cash management: putting as much cash to work, through increased short-term investment/debt repayment. In the current environment where the expectation is for variable rates to increase significantly, the cost of debt is increasing sharply. If your organization paid down $10 million in debt at a cost of .5%, future interest payments would have been reduced by $50,000 per year. At 2% interest rates, the savings would be $200,000 so each additional dollar has four times the impact.

Companies with FX exposure should review their hedge effectiveness and tools to identify and monitor their exposure. Ineffective hedging programs impact the liquidity forecast and result in inefficient liquidity management.

Effective liquidity management requires three ingredients to mellow out the volatility stew:

- Real-time visibility into cash

- Cash forecast accuracy and scenario analysis

- Accurate FX exposure identification and hedge effectiveness.

In fact, the 2020 AFP Strategic Role of Treasury Survey Report found that 68% of treasury professionals believe the greater value assigned to treasury will continue over the next three years, with credit availability, forecast accuracy and liquidity as top KPIs used to measure performance.

Organizations, particularly those with global operations, are deploying technology to enhance visibility, forecasting, and FX risk management. The same AFP study found two-thirds of treasury practitioners cited technology as critical for supporting their strategic role.

An enterprise liquidity platform provides 100% real time visibility of all its bank accounts. This visibility into current cash is fully integrated to the accurate cash forecast, payments, and hedging flows. Advanced technology such as business intelligence, machine learning, dashboards and FX exposure identification and monitoring provide powerful analytical tools. Real-time views of liquidity, risk and scenario analysis result in informed decisions managing cash and exposure mitigation, with all cash movements, hedge actions and forecast changes immediately incorporated into current and future views of liquidity.

The cost of doing nothing has gone up and companies should assess the efficiency of their cash management processes and risk mitigation. Missing key ingredients to manage the volatility stew is a recipe for disaster.

References

- Organization for Economic Co-operation and Development, Immediate Rates: Less than 24 Hours: Call Money/Interbank Rate for the United States [IRSTCI01USM156N], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IRSTCI01USM156N, May 25, 2022.

- Ice Data Indices, LLC, ICE BofA US High Yield Index Effective Yield [BAMLH0A0HYM2EY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLH0A0HYM2EY, May 25, 2022.

- Ice Data Indices, LLC, ICE BofA BBB US Corporate Index Effective Yield [BAMLC0A4CBBBEY], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/BAMLC0A4CBBBEY, May 25, 2022.

- Federal Reserve Bank of Atlanta, Sticky Price Consumer Price Index [STICKCPIM159SFRBATL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/STICKCPIM159SFRBATL, May 25, 2022.

- Board of Governors of the Federal Reserve System (US), Nominal Broad U.S. Dollar Index [DTWEXBGS], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DTWEXBGS, May 24, 2022.

- 2020 AFP Strategic Role of Treasury Survey Report, Association For Financial Professionals; afponline.org; https://www.afponline.org/docs/default-source/registered/rsch-20_strategic_role_of_treasury_final.pdf